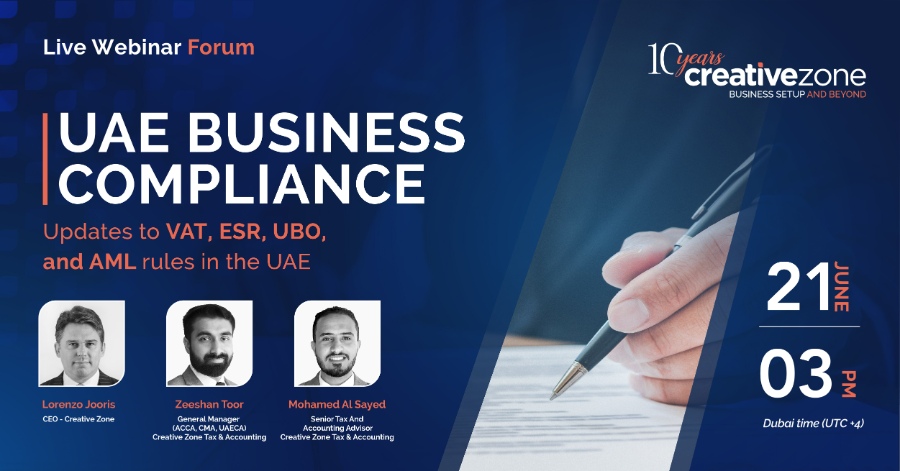

| Mohamed Al SayedHead of Tax, Creative Zone Tax & AccountingMohamed Sayed is a Registered Tax Agent, accredited by the Federal Tax Authority, holding a high degree of training and accuracy in administrative, legal and practical elements of tax. A former employee of the Federal Tax Authority (FTA) in the UAE, Mohamed was also awarded the GCC VAT Compliance Diploma from the Association of Taxation Technicians. His expertise in tax and company law has assisted clients in public as well as private sectors. Mohamed helps you not only to remain tax compliant but also stay one step ahead of the curve with the latest updates from the FTA. Currently, Mohamed is presently the Head of Tax at Creative Zone Tax & Accounting, tailoring the best solutions for our clients to ensure complete compliance. |

| Zeeshan ToorGroup Head of Finance, Creative ZoneWith over 10 years of experience in financial management, tax advice, compliance, and business strategy, Zeeshan Toor is a highly skilled professional known for his strategic insights and leadership. He joined Creative Zone in 2017, and since then, he has been one of the key drivers in the company’s growth within 8 years. His deep understanding of client needs, combined with his analytical skills, enables him to provide tailored, value-driven solutions that improve business operations and decision-making. Zeeshan’s diverse expertise is backed by world-renowned certifications including FCCA, CMA, and UAECA, ensuring he brings the highest standard of professionalism to every project. His exceptional leadership and ability to drive change were recognized when he was selected as "CEO for 1 Month" by Adecco Middle East. Before joining Creative Zone, he played a pivotal role in streamlining financial processes at ACS Trading LLC, a company with annual revenues exceeding AED 500 million. |